Capital Gains Tax (CGT) is a tax levied on the profit made from selling an asset, like stocks, bonds, real estate, or even collectibles. Understanding CGT is crucial for effective financial planning. Firstly, it’s not a tax on the total sale price, but rather the *gain*, which is the difference between what you sold the asset for and what you originally paid for it (plus any allowable expenses like broker fees or improvements made to the asset). Secondly, CGT rates differ based on how long you held the asset. Generally, assets held for longer than one year qualify for lower, long-term capital gains rates. Assets held for a year or less are taxed at your ordinary income tax rate, which is often higher. Thirdly, several strategies can help minimize your CGT liability. One common approach is tax-loss harvesting. This involves selling investments at a loss to offset capital gains. The losses can offset gains dollar-for-dollar, and if your losses exceed your gains, you can typically deduct up to $3,000 of those losses against your ordinary income. The remainder can be carried forward to future tax years. Another strategy involves utilizing tax-advantaged accounts like 401(k)s, IRAs, or HSAs. Investments held within these accounts grow tax-deferred or even tax-free, potentially avoiding CGT altogether. Careful record-keeping is also vital. Maintaining accurate records of your purchase price, sale price, and any associated expenses will help ensure you’re calculating your capital gains correctly and claiming all eligible deductions. Finally, be aware of any applicable exemptions or special rules that may apply to your situation. For example, there are often specific rules related to the sale of a primary residence, which may allow you to exclude a significant portion of the profit from CGT. Tax laws can be complex and change frequently. Therefore, it’s always a good idea to consult with a qualified tax professional or financial advisor to understand how CGT affects your specific financial circumstances and to develop a tailored tax-efficient investment strategy. They can help you navigate the intricacies of CGT and make informed decisions to minimize your tax burden and maximize your financial well-being.

768×1024 cgt summary capital gains tax capital gain from www.scribd.com

768×1024 cgt summary capital gains tax capital gain from www.scribd.com

768×1024 tabl cgt assignment capital gains tax money from www.scribd.com

768×1024 tabl cgt assignment capital gains tax money from www.scribd.com

1783×2138 cgt from cgt-inc.com

1783×2138 cgt from cgt-inc.com

1365×768 matching settlement receipts cgt liability returning cgt from pointonpartners.com.au

1365×768 matching settlement receipts cgt liability returning cgt from pointonpartners.com.au

1024×852 img cgt flickr from www.flickr.com

1024×852 img cgt flickr from www.flickr.com

1200×630 cgt sdis app store from apps.apple.com

1200×630 cgt sdis app store from apps.apple.com

320×240 cgt intro from www.slideshare.net

320×240 cgt intro from www.slideshare.net

1024×660 history cgt cgt from cgt-help.co.uk

1024×660 history cgt cgt from cgt-help.co.uk

1920×1279 cgt property advice moneysavingexpert forum from forums.moneysavingexpert.com

1920×1279 cgt property advice moneysavingexpert forum from forums.moneysavingexpert.com

988×531 capital gains tax cgt swot accountants from www.swotaccountants.com.au

988×531 capital gains tax cgt swot accountants from www.swotaccountants.com.au

800×566 cgt incorporation relief zincbooks from www.zincbooks.co.uk

800×566 cgt incorporation relief zincbooks from www.zincbooks.co.uk

1600×1157 cgt stock royalty stock dreamstime from www.dreamstime.com

1600×1157 cgt stock royalty stock dreamstime from www.dreamstime.com

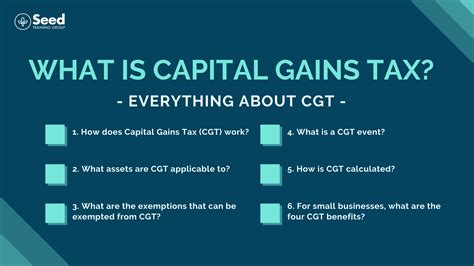

1920×1080 capital gains tax cgt cgt from seedtraining.com.au

1920×1080 capital gains tax cgt cgt from seedtraining.com.au

768×576 cgt system reports from studylib.net

768×576 cgt system reports from studylib.net

866×720 capital gains tax cgt from www.linkedin.com

866×720 capital gains tax cgt from www.linkedin.com

1920×1440 rumours cgt increases beavis morgan accountants tax business from www.beavismorgan.com

1920×1440 rumours cgt increases beavis morgan accountants tax business from www.beavismorgan.com

768×512 cgt discount companies trusts tax talks from www.taxtalks.com.au

768×512 cgt discount companies trusts tax talks from www.taxtalks.com.au

940×600 cgt exemptions depreciating assets tas eastern suburbs from tailoredaccountingsolutions.com.au

940×600 cgt exemptions depreciating assets tas eastern suburbs from tailoredaccountingsolutions.com.au

800×800 day cgt report taxeezy from taxeezy.co.uk

800×800 day cgt report taxeezy from taxeezy.co.uk

1827×1080 cgt season rcarporn from www.reddit.com

1827×1080 cgt season rcarporn from www.reddit.com

320×180 cgt rollover relief marriage breakdown family business accountants from www.slideshare.net

320×180 cgt rollover relief marriage breakdown family business accountants from www.slideshare.net

1200×675 managing capital gains tax smsf from www.superguide.com.au

1200×675 managing capital gains tax smsf from www.superguide.com.au

1024×683 cgt event time options rigby cooke lawyers from www.rigbycooke.com.au

1024×683 cgt event time options rigby cooke lawyers from www.rigbycooke.com.au

1859×600 deadline pay cgt residential property reduced days from www.linkedin.com

1859×600 deadline pay cgt residential property reduced days from www.linkedin.com

800×450 avoid paying cgt selling investment property from propertyupdate.com.au

800×450 avoid paying cgt selling investment property from propertyupdate.com.au

1500×751 pre cgt shares company assets tax talks brown wright stein from www.bwslawyers.com.au

1500×751 pre cgt shares company assets tax talks brown wright stein from www.bwslawyers.com.au

4596×3123 cgt allowance reduced psk april accountancy daily from www.accountancydaily.co

4596×3123 cgt allowance reduced psk april accountancy daily from www.accountancydaily.co

1300×956 cgt capital gains tax stacked coins isolated white background from www.alamy.com

1300×956 cgt capital gains tax stacked coins isolated white background from www.alamy.com

1627×666 cgt lodgeit from help.lodgeit.net.au

1627×666 cgt lodgeit from help.lodgeit.net.au

640×779 capital gains tax cgt rupscpreparation from www.reddit.com

640×779 capital gains tax cgt rupscpreparation from www.reddit.com

1024×576 capital gains tax cgt powerpoint from www.slideserve.com

1024×576 capital gains tax cgt powerpoint from www.slideserve.com

768×768 guide small business cgt concessions cadena legal from cadenalegal.com.au

768×768 guide small business cgt concessions cadena legal from cadenalegal.com.au

768×432 understanding small business cgt year exemption impala tax from impalatax.com.au

768×432 understanding small business cgt year exemption impala tax from impalatax.com.au

1600×1157 capital gains tax cgt concept business documents stock photo image from www.dreamstime.com

1600×1157 capital gains tax cgt concept business documents stock photo image from www.dreamstime.com

1024×529 capital gains tax cgt australia from taxly.ai

1024×529 capital gains tax cgt australia from taxly.ai